“The 5-Minute Year-End Tax Move That Could Let LLC Owners Write Off Thousands Before Midnight — Even If You’ve Waited All Year”

Why a 200-page tax code loophole quietly allows small-business owners to “erase” income — legally — if they act before December 31…

$27

From ($449.00)

YOU'RE SAVING $442!

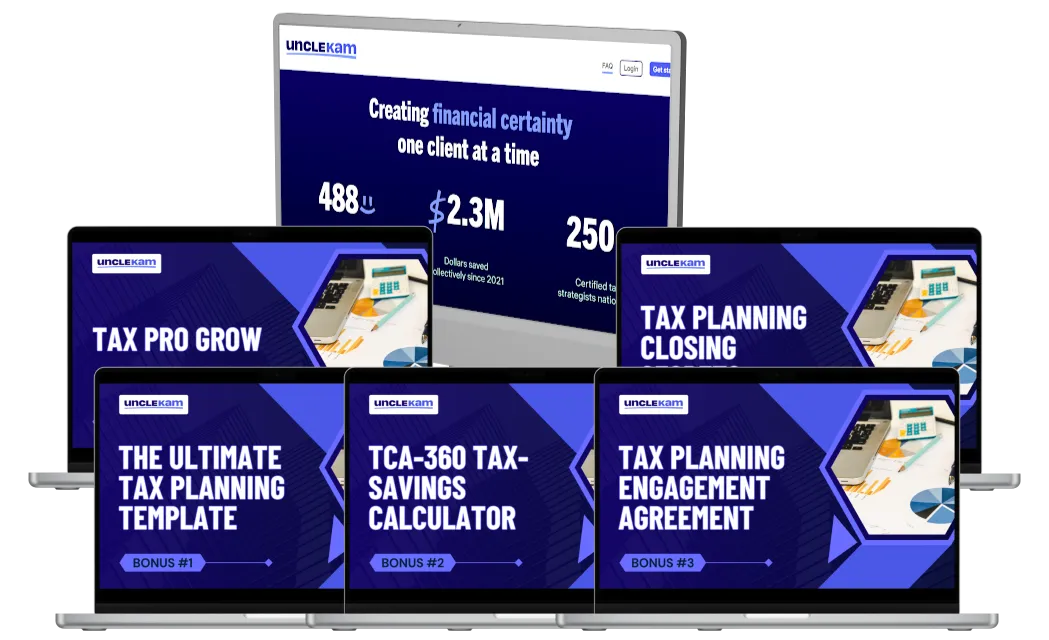

GRAB TODAY FOR ONLY $27

Digital Download | 7 Proven Tools + Templates | 3 FREE Bonuses

Based on Karla Dennis’ proven MERNA™ Method

Backed by our 90 day money back guarantee. You'll love it, or we'll give you your money back

What you will get

Year-End LLC Moves Playbook – Unlock 12 hidden "loophole" write-offs you can still grab before Dec 31 and learn the fast, legal way to pull thousands in deductions forward before the IRS closes the books.

End-of-Year Compliance Checklist – Stay audit-safe with a one-page year-end closeout that ensures your books, filings, and reimbursements are 100 % buttoned up.

Mileage + Home-Office Toolkit – Instantly calculate and claim everyday deductions with auto-logs, mileage trackers, and square-foot calculators that do the math for you.

Audit-Proof Bookkeeping System – Turn messy books into clean, compliant records in 7 days with plug-and-play cleanup templates and automations used by pros.

Live “Close the Year Right” Workshop – Join Karla Dennis live for 90 minutes of real-time, year-end strategy coaching and discover how to squeeze out every dollar of savings before midnight.

2025 Tax Moves Forecast Bonus – Get a sneak peek at next year’s top 5 tax deductions and rule changes so you can stay ahead—and start January already winning.

Total Value $449 → Today Only $27

From The Desk Of Karla Dennis,

Every December, millions of small-business owners make the same painful mistake.

They wait.

They wait for January to “see how the year looks.”

They wait for their accountant to “work the numbers.”

They wait for the IRS to decide how much of their hard-earned income they get to keep.

And by the time those forms are filed… it’s too late.

Because once the calendar flips, every dollar you didn’t move before December 31 belongs to someone else.

I’m not talking about cheating the system.

I’m talking about using the system — the exact same rules that Fortune 500 companies and well-advised entrepreneurs use to reduce their taxable income by 20-40% every single year.

And here’s the forbidden truth no accountant will tell you during tax season:

The IRS doesn’t reward you for filing — it rewards you for acting early.

The window is still open — but it’s closing fast.

Right now, before midnight on December 31, you have a once-a-year opportunity to legally shift thousands of dollars from the government’s pocket back into yours.

All it takes is a few intentional “Year-End Moves” — steps that can be completed in minutes and validated by your accountant later.

This short playbook was designed specifically for LLC owners who procrastinated all year, thought they’d missed their chance… and still want to finish strong.

Before I show you exactly how these Year-End Moves work — and why they’re so effective you can implement them this week — let me introduce myself.

Karla Dennis

My name is Karla Dennis.

I’m an Enrolled Agent, a federally licensed tax expert recognized by the IRS — and for the last two decades, I’ve helped thousands of small business owners, real estate investors, and entrepreneurs legally save millions on taxes.

You may have seen me on NBC, CBS, FOX, or in Forbes, breaking down the hidden advantages the tax code gives to proactive business owners.

Or maybe you’ve come across my firm, Karla Dennis & Associates, where our team of licensed strategists manages the books and tax plans for clients across all 50 states.

But none of that matters as much as this:

Every year around this time, right before December 31, my phone rings with panic.

Business owners who’ve had a great year — record sales, record revenue — call me with the same question:

“Karla… is there anything I can still do to save on taxes before the year ends?”

And for most accountants, the answer is no.

For me? It’s absolutely.

The strategies inside this playbook come straight from Karla Dennis’ proprietary MERNA™ Framework — the same system used by our clients to legally save $20K – $50K per year.

Each move you’ll learn is a real, IRS-compliant strategy proven to help business owners keep more of what they earn.

Because unlike the average CPA who files your return after the fact, my team and I specialize in Year-End Strategy — moves you can make before the IRS closes the book on this tax year.

I’ve seen both sides of this equation — the clients who plan early and keep thousands in their pocket…

And the ones who hand over an unnecessary check to the IRS simply because no one told them what was possible.

The difference isn’t money.

It’s timing.

That’s what this short, actionable guide — Year-End LLC Moves: Save Before 12/31 — was designed to fix.

You don’t need a team of accountants.

You don’t need to hire a high-end firm.

And you definitely don’t need to know 500 pages of IRS code.

You just need to know which buttons to push before midnight.

How a Client Saved Over $37,800 in Taxes in a Single Week

So before we run out of time — let me show you a quick story about how one of my clients used these same last-minute moves to save $37,800 in a single week.

Because once you see this, you’ll realize how much you’re still leaving on the table.

Last year, just a few days before Christmas, I got a call from one of my clients — Andrea, a single-member LLC owner from Texas.

She sounded defeated.

She’d had a great year — $186,000 in revenue — but she hadn’t done anything for tax planning.

Her books were messy, receipts unorganized, and her accountant had already warned her,

“You’ll probably owe around $45,000 in taxes.”

Her words to me were almost a whisper:

“Karla, I can’t believe I worked this hard just to give half of it away.”

I told her what I’m about to tell you:

“You still have time. The IRS clock hasn’t hit midnight yet.”

So we went to work.

In less than 15 minutes, we ran through a few of the Year-End LLC Moves you’ll find in this Playbook.

Move #1:

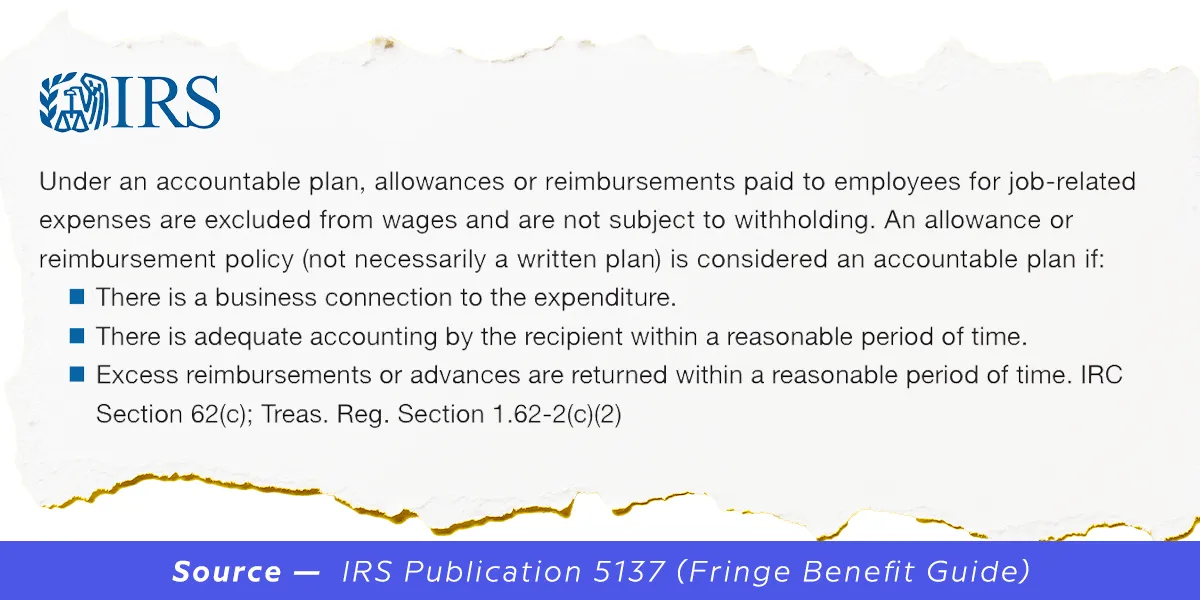

We set up an Accountable Plan — a simple way for LLC owners to reimburse themselves for legitimate business expenses they’ve already paid out of pocket.

Move #2:

We created a quick inventory and supply pre-purchase list — stocking up before December 31 so her expenses hit this year’s books, not next year’s.

Move #3:

We helped her open a Solo 401(k) and pushed a partial contribution before year-end, locking in an immediate deduction.

That’s it.

Three simple moves.

Fifteen minutes of action.

And when we recalculated her estimated taxes?

Her taxable income dropped by $37,800.

That meant nearly $9,000 in taxes wiped away before the ball even dropped in Times Square.

Andrea’s reaction After Saving $37,800?

She cried.

Not because of the money — but because she finally understood what no one had ever explained to her before:

It’s not about how much you make. It’s about when you move.

She didn’t hire a fancy tax attorney.

She didn’t restructure her business.

She just used a small handful of Year-End LLC Moves that 99% of business owners don’t even know exist.

And this isn’t some one-time miracle.

Every December, I see the same pattern play out — LLC owners who thought it was “too late” walk away with thousands saved, just by learning how to legally adjust the timing of their deductions.

If Andrea could do it between holiday parties and end-of-year chaos, imagine what you could do with a clear checklist and my exact step-by-step Playbook.

That The Power OF A Year End Strategy

It’s not complicated. It’s not advanced. It’s not even “tax planning” in the traditional sense.

It’s simply using the IRS’s own calendar against itself.

And once you see how the mechanism works… you’ll realize you can use it every year.

Here’s the real reason these “Year-End Moves” work —

and why they succeed when every accountant’s March strategy fails.

It’s something I call “Tax Gravity.”

You can’t see it.

You can’t touch it.

But it’s quietly pulling money away from your business every single day that passes after December 31.

The IRS tax code is built on a single invisible rule:

“He who acts first, wins.”

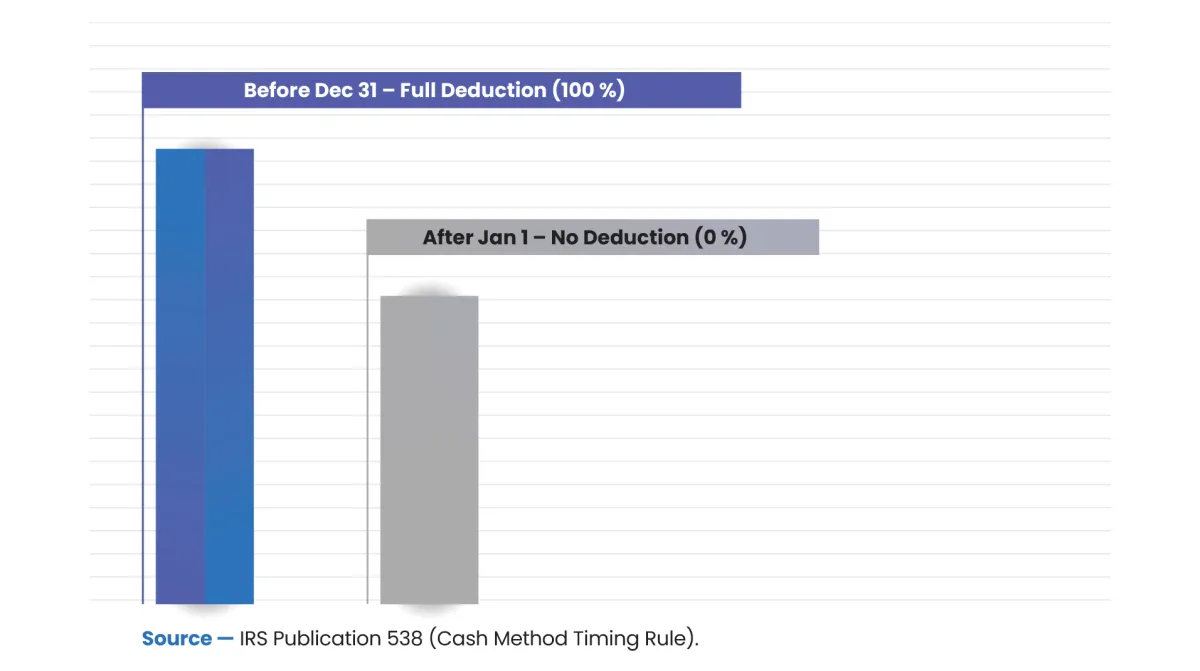

If you spend before December 31 — the tax code rewards you.

If you wait until January — it punishes you.

That’s because most LLCs operate on a cash-basis system — meaning the IRS only recognizes income and expenses in the year they occur.

So, every time you:

reimburse yourself through an Accountable Plan,

prepay for supplies or subscriptions,

contribute to a retirement account,

or even log legitimate mileage before year-end —

Your Bending The IRS Clock In Your Favor

Each move pulls deductions forward into this year while pushing taxes back into next.

That’s the “Tax Gravity Effect.”

And here’s the kicker — the IRS wrote these rules on purpose.

They want small business owners to stimulate the economy by spending, contributing, and investing before year-end.

The problem is, your accountant doesn’t call you in December to remind you.

They just file what’s already happened — not what could have been saved.

Because when you understand Tax Gravity, you stop “filing” and start forecasting.

One path gives the IRS an interest-free loan.

The other path gives you leverage — deductions, liquidity, and freedom.

And here’s the truth I’ve learned after twenty years of running one of the most trusted tax firms in America:

95% of small business owners lose money they could have kept —

simply because they didn’t make the right year-end moves in time.

The good news?

You don’t have to spend weeks learning all 800 pages of tax code to use this power.

You just need a simple, guided checklist that shows you exactly what to do before the clock runs out.

That’s exactly what the Year-End LLC Moves Playbook was built to do — turn last-minute panic into last-minute profit.

Now that you understand why this works…

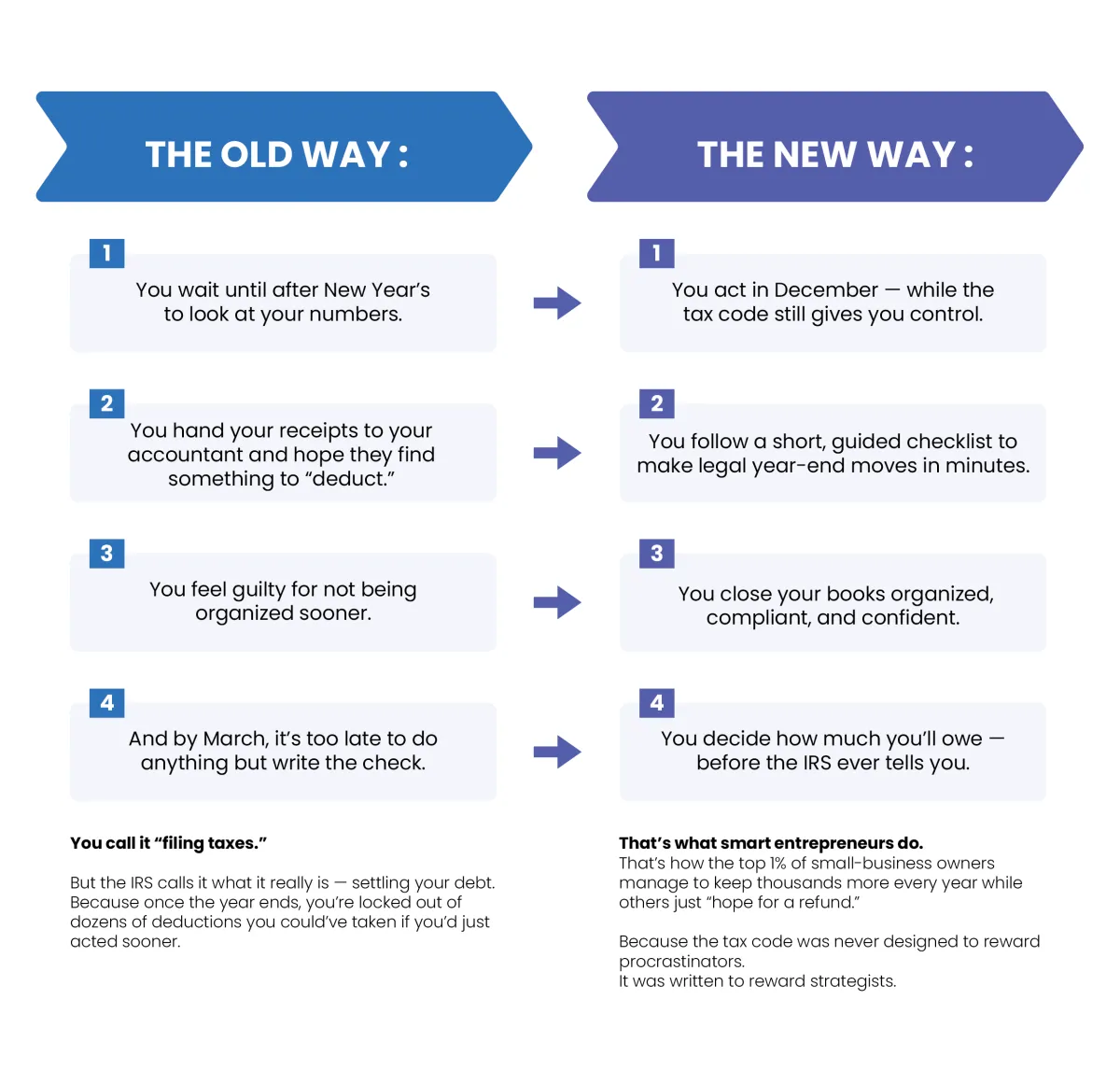

Let’s look at how the old system keeps you trapped — and what the “new way” looks like when you start playing offense instead of defense.

For most business owners, tax season feels like this:

You work 12 months.

You finally catch your breath in January.

Then your accountant calls with one question that makes your stomach drop:

“Can you send over your books so we can see what you owe?”

Let’s be honest:

Nobody teaches you this stuff when you start an LLC.

They tell you to open a bank account, get QuickBooks, pay quarterly, and pray you did it right.

But no one shows you the leverage hiding in the timing.

The IRS doesn’t play fair — it plays fast.

You either act before midnight… or you donate your savings to Washington.

When You Act

Who’s in Control

What You Feel

Result

The Old Way

After the year ends

The IRS

Panic

Pay more tax than you should

The New Way

Before December 31

You

What You Feel

Keep thousands legally

And the best part?

You don’t need to be an expert, a bookkeeper, or even “good with numbers.”

You just need a system — a guide that shows you where to point your focus during the final stretch of the year.

That’s exactly what this is.

But I get it — if you’ve been burned by bad advice or felt overwhelmed by tax jargon before, you might be thinking:

“Why haven’t I heard this before?”

Let’s bridge that next.

Let’s be honest —

you didn’t start your business to become a tax expert.

You started it to create freedom.

To take care of your family.

To break away from the grind and build something that’s yours.

But somewhere along the way, the system made you feel like you were doing it wrong.

You’ve been told:

“You can’t change your taxes now.”

“That deduction doesn’t apply to you.”

“You should’ve planned earlier.”

Every time you ask a question, you get jargon.

Every time you try to plan, it feels like you’re too late

So, what do most people do?

They give up.

They accept that taxes are just a painful, once-a-year donation to the government.

But here’s the truth:

It’s not your fault.

Nobody ever taught you how the game is played.

The IRS doesn’t send you a postcard in November saying,

“Hey, here are the 12 moves you can make before December 31 to legally keep your money.”

Of course not.

Because the longer you wait, the more you pay.

Meanwhile, the wealthy — the ones with advisors and strategists — make their year-end moves in silence.

They finish December with deductions locked, books balanced, and champagne in hand.

They don’t know more than you.

They just move differently.

That’s exactly what this playbook helps you do.

It gives you a simple checklist, built for busy LLC owners, to make strategic moves without learning 1,000 tax codes or calling your accountant every five minutes.

It’s about reclaiming your power before the clock runs out.

So if you’ve ever looked at your tax bill and thought,

“How do they always seem to pay less than me?”

You’re about to find out.

Because once you see how these moves work, you’ll never go back to the old way again.

Next, I’ll show you what happens when real business owners start applying these strategies — and why this proof-first method has quietly saved entrepreneurs over $10 million in combined taxes, one December at a time.

“Real LLC Owners. Real Savings. Real Fast.”

When I first released a small version of this playbook last December, I thought only a handful of people would grab it.

By the end of the week, over 4,000 business owners had downloaded it. And what happened next shocked even me.

And those are just the early ones.

By the second week, my inbox was filled with subject lines like:

“Holy cow, this worked!”

“Why didn’t anyone tell me this before?”

“Can I use this every year?”

We compiled the data:

92% of LLC owners who downloaded the playbook implemented at least one strategy within 48 hours.

Average documented savings? $3,412 each — all from actions they took before year-end.

These aren’t loopholes or gray-area tricks.

They’re legitimate, IRS-compliant strategies hiding in plain sight — unlocked simply by knowing when to use them.

And here’s what’s even more exciting:

Once those business owners saw the power of their first move, most didn’t stop there. They joined my January “Close the Year Right” Workshop to keep the momentum going.

That’s where I watched a small group of determined LLC owners transform their relationship with taxes — from fear to mastery.

They stopped dreading the IRS.

They started playing offense.

And that’s the kind of quiet confidence I want for you too.

“I found $2,913 in deductions the same night. My accountant said it was the easiest year-end he’s ever seen.”

Marcus B., Fitness Coach, Florida

“I finally understood what my CPA meant by ‘timing.’ I implemented two moves and cut my tax bill by $5,700.”

Ellie P., Etsy Seller, California

“The checklist saved me. I didn’t even know I could reimburse myself through an accountable plan. I got back $8,200 legally.”

Ramon K., Consultant, Illinois

“This wasn’t theory — it was action. I did the first move that night, and my bookkeeper literally texted me: ‘You just saved 4 grand.’”

Katie L., Real Estate Agent, Texas

Because when you see proof like this, one thing becomes crystal clear:

This isn’t about luck — it’s about leverage.

Let me explain the simple logic behind that leverage — the part that makes the IRS code work for you instead of against you.

“Why This Always Works (When You Do It Before 12/31)”

At this point, you’ve seen the stories.

You’ve seen the numbers.

But here’s what matters most: this isn’t random.

Every single result — from Andrea’s $9,000 savings to Katie’s 4-grand write-off — came from the same repeatable principle baked right into the IRS playbook itself.

It’s not secret.

It’s just ignored.

Let me show you.

The IRS Built a Reward System for Action-Takers

The tax code is full of timed triggers — deductions that only count if they happen before December 31.

Spend on business supplies before year-end → write it off now.

Reimburse yourself under an Accountable Plan → deduction locked in this year.

Contribute to your Solo 401(k) → instantly reduce taxable income.

Document mileage and home-office use → turn everyday life into legal deductions.

These aren’t gimmicks. They’re line items in IRS Publications 463, 535 and 560 — the same ones corporate CFOs study to protect millions.

The only difference? They act early.

You wait.

And waiting kills deductions.

“But I’ll Just Handle It at Tax Time…”

That’s what most business owners tell themselves — until their accountant says the words no entrepreneur wants to hear:

“If you didn’t do it before December 31, we can’t count it.”

By then, it’s not a tax plan — it’s a post-mortem.

And that’s the single biggest lie the system sells:

That your taxes are decided in April.

They’re not.

They’re decided in December.

The Physics of Tax Savings

“If you didn’t do it before December 31, we can’t count it.”

That’s why I call this the Tax Gravity Effect.

Once you understand it, you can’t unsee it.

And once you apply it, you’ll never go back to hoping for a refund again.

Think of your finances like gravity.

Money naturally “falls” toward the IRS unless you redirect it with legal counter-moves.

Every deduction you document before year-end changes the slope — pulling dollars back into your pocket.

So if you’ve ever felt unlucky, confused, or left behind — you weren’t broken.

You were simply playing the wrong game at the wrong time.

The Year-End LLC Moves Playbook flips that clock in your favor.

Now that you know why it works, let’s paint the picture of what life looks like once you start using it — how it feels to finally step into the new year already ahead.

What Happens When You Beat the Clock”

It’s December 31.

But instead of staring at your books in panic, you’re calm.

You’ve spent less than an hour going through your checklist.

You’ve reimbursed yourself, logged your miles, topped off your retirement, and stocked up on next year’s supplies.

You close your laptop.

The year is done — clean, documented, compliant, and fully optimized.

While everyone else is still guessing what they’ll owe in April…

you already know.

You can feel it — that deep, quiet confidence that comes when you finally understand the rules.

In January, you don’t dread your accountant’s email.

You look forward to it.

Instead of “we’ve got bad news,” you hear:

“Your numbers look great — your taxes are lower than expected.”

That’s not luck.

That’s leverage.

It’s the difference between feeling behind and feeling in control.

The Ripple Effect

Once you experience it, everything changes.

You start noticing deductions automatically — the mileage on your car, the square footage of your home office, the business subscriptions you can prepay.

You stop feeling afraid of the IRS and start using their rules to your advantage.

And here’s the beautiful irony:

The same system that used to stress you out becomes the system that protects you.

Your business grows cleaner, stronger, and more profitable — because you’re no longer leaking money through inaction.

The Deeper Reward

This isn’t just about saving money.

It’s about peace of mind.

The kind that lets you focus on building your business, serving clients, and enjoying your life — without that constant, nagging voice asking,

“Did I do enough before year-end?”

You’ll know you did.

You’ll enter the new year lighter — financially and mentally — because you didn’t just “file your taxes”…

You commanded them.

And here’s the best part — you don’t have to guess, learn from scratch, or hire anyone to experience this transformation.

I’ve already mapped out every single move for you inside the Year-End LLC Moves Playbook.

Let me show you exactly what you get today.

Everything You Need to Lock In Year-End Savings Before the Clock Strikes Midnight”

By now, you know the opportunity —

and you understand the why.

Now let’s make sure you have every tool to actually do it.

Because reading about these moves is one thing.

Executing them before December 31 is where the real money is made.

That’s why I created a simple, all-in-one system called the Year-End LLC Moves Playbook —

the fastest, most practical way to finish your year with confidence, clarity, and real tax savings.

Here’s What You Get When You Order Today

The Year-End LLC Moves Playbook ($97 Value)

Your step-by-step manual for turning last-minute panic into last-minute profit.

you’ll discover:

The 12 most overlooked deductions that expire at midnight on 12/31

How to “backdate” business reimbursements legally using the Accountable Plan strategy

The checklist that lets you prepay expenses the IRS wants you to use

A 5-minute timing trick that can shift thousands in taxable income into next year

Real examples and line-by-line templates you can copy today

It’s like having a year-end strategist sitting next to you — walking you through exactly what to do, in what order, and what proof to keep.

The End-of-Year Compliance Checklist ($49 Value)

Every box you check equals more confidence come audit time.

This printable checklist covers:

Entity compliance (EIN, state filings, minutes, W-9s)

Financial closeout (P&L, receipts, reconciliations)

Tax-deductible actions (contributions, purchases, reimbursements) By the time you finish this, your books will look audit-proof.

BONUS #1: Mileage & Home Office Toolkit ($9 Value)

Your everyday life is full of hidden deductions — this toolkit makes sure you capture them.

You’ll get:

An auto log that calculates business-use percentages for you

A home-office calculator that instantly computes deductible square footage

Plug in your data → print your results → lock in deductions the IRS already allows.

BONUS #2: Bookkeeping to Audit-Proof in 7 Days ($97 Value)

This is the fast-track system I use with new clients to clean messy books fast.

You’ll get:

My custom Chart of Accounts template

The Monthly Close SOP used by my firm

Automation steps to connect your receipts, transactions, and reports. With this, you can fix a year’s worth of chaos in less than a week.

BONUS #3: LIVE “Close the Year Right” Workshop ($197 Value)

Join me for a 90-minute live training where I’ll personally walk you through:

How to use every deduction in your playbook

Which moves to prioritize for your specific business

How to make sure your accountant can’t miss a thing.

Seats are limited (I only host a few of these before year-end).

Total Value: $449+

Your Price Today: Just $27

Yes, you read that right — less than the cost of lunch.

Because I don’t want price to be the reason you miss out on thousands in savings.

This is your end-of-year insurance policy against overpaying the IRS.

Special Fast-Action Bonus (Today Only)

Order before midnight tonight and you’ll also get:

“The 2026 Tax Moves Forecast” Mini Guide ($29 Value)

— a sneak peek at the top 5 new deductions and policy changes coming next year, so you can start January ahead of everyone else.

Backed by our 365-day money back guarantee. You'll love it, or we'll give you your money back

Now, here’s where things get serious —

because this offer expires for a reason.

You only have until December 31 to make these moves.

And once the clock resets… so do your opportunities.

Let’s talk about that urgency, the guarantee, and why this is truly risk-free.

“The Clock Is Ticking

— and So Are Your Deductions”

Here’s the truth most people never hear:

The IRS doesn’t care how hard you’ve worked this year.

It only cares what you document before December 31.

Once the clock strikes midnight, every unused deduction resets.

The miles you didn’t track? Gone.

The reimbursements you didn’t claim? Gone.

The contributions you didn’t make? Gone.

It’s the biggest financial “do-over” you’ll never get back.

That’s why every hour between now and year-end matters — because what you do in the next few days determines how much you keep next year.

The $27 Decision

That’s all this takes — $27.

Not for theory.

Not for another 2-hour YouTube rabbit hole.

But for the exact Year-End LLC Moves Playbook that’s already helped thousands of entrepreneurs legally save $3,000… $5,000… even $10,000 before New Year’s Eve.

Ask yourself — what’s the ROI on $27 if it saves you even one extra deduction?

That’s the price of dinner.

But this dinner buys you peace of mind for an entire year.

Your “IRS-Proof” Guarantee

I built this system for real business owners who don’t have time for guesswork.

So here’s my promise to you:

Try the Playbook for 7 days.

If you don’t uncover at least one deduction you can use this year to lower your taxes, I’ll refund your $27 — and you can keep the entire Playbook anyway.

That means your risk is zero.

Either you save money… or you get your $27 back and keep the blueprint for free.

There’s no small print.

Just results.

The Value Equation

You’re getting over $449 worth of strategy tools —checklists, templates, live training, calculators - for a one-time $27 investment.

If these moves help you claim even one $500 expense or one extra write-off…you’ve already made 13x your money back — instantly.

Every additional deduction is just profit.

And here’s the secret my clients learn fast:

“Once you know how to do this, you can use it every year.”

That’s the kind of skill that compounds — savings on autopilot, year after year.

The Belief Close

I’ve watched too many business owners end their year in regret —

Working harder than ever, only to send thousands to the IRS they didn’t need to.

But not you.

Not this year.

This time, you have the playbook.

You have the moves.

You have the chance to finish strong — and start next year ahead of the curve.

Don’t let another December pass without using what’s yours.

“Beat the Clock. Keep Your Cash.”

Click below now to claim your Year-End LLC Moves Playbook

for just $27

and get instant access to every tool, bonus, and checklist.

Your purchase is 100% risk-free, protected by my 365-Day “IRS-Proof” Guarantee.

P.S. Remember: every deduction you don’t take before December 31 is money you’ll never see again.

The difference between “too late” and “right on time” could be thousands in your pocket.

Don’t wait until January to realize what you missed.

Grab your Playbook now, while there’s still time to make every move count